Contents:

In summary, the ADX did not rise past 25 until the third green circle. Conducting a short trade from that point until the final green circle could have yielded a gain of 200 pips. If you had been a nimble trader, you could have gained another 300 pips via trades from points “D” and “E”. If you had used additional indicators, then the opportunity for trades from “A” through “C” could have added another 250 pips to the total. An Average DM for N periods is calculated for positive and negative trends. Positive and negative DM indicators are developed based on the previous period’s high/low values.

- The reason why the ADX indicator is so popular is that it is very informative.

- Join thousands of traders who choose a mobile-first broker for trading the markets.

- Though the average directional movement index does not show the direction of a trend as long or short, a value over 40 clearly indicates there is strength in the current trend.

- We’re going to start with an older volume indicator called the Average Directional Movement Index, or ADX.

The ADX makes use of a positive (+DI) and negative (-DI) directional indicator in addition to the trendline. The direction of the ADX line is important for reading trend strength. When the ADX line is rising, trend strength is increasing, and the price moves in the direction of the trend. When the line is falling, trend strength is decreasing, and the price enters a period of retracement or consolidation.

A falling ADX line only means the trend strength is weakening, but it usually does not mean the trend is reversing unless there has been a price climax. As long as ADX is above 25, it is best to think of a falling ADX line as simply less strong. Let’s look at this essential indicator in more detail – and see how to apply it on your forex charts, to give you greater accuracy when generating your trading signals. By using a sample size of 50 candlesticks to determine the trend we ensure that we trade in the moment of now.

What is ADX?

For our entry signal, we’ll be using the RSI indicator that uses the same settings as the ADX indicator settings. Normally the RSI reading below 30 shows an oversold market and a reversal zone. However, smart trading means looking beyond what the textbook is saying. The best ADX strategy also incorporates the RSI indicator in order to time the market. The ADX indicator can only help us to gauge the intensity of the trend. Detecting a strong directional move is the most important skill for all traders to have.

The indicator is usually plotted in the same window as the two directional movement indicator lines, from which ADX is derived . Unlike Stochastic, ADX does NOT determine whether the trend is bullish or bearish. Rather, it merely measures the strength of the current trend. The all-adx-indicator.ex4 is a technical tool used in gauging trend direction, as well at its accompanying strength. If the fx-sniper indicator line reverts to medium sea green during the course of a bearish trend, it is suggestive of a bullish reversal, therefore an exit or take profit is advised.

The https://forexhero.info/ moves in a narrow range between strong support and resistance levels. The EMA indicator is an exponential moving average and TR means true range, which shows the entire range conditions of an asset price. When the oscillator’s main line exits the 0-20% zone (in some cases, 0-25%), it signifies the beginning of a trending market. When the main indicator line enters the 50-60% zone, it’s a signal that the potential trend reversal. The Average Directional Index is a very useful tool for trend traders.

Needs to review the security of your connection before proceeding. ADX is simply the mean, or average, of the values of the DX over the specified Period. Place a stop-loss order at 25 “pips” below your entry point.

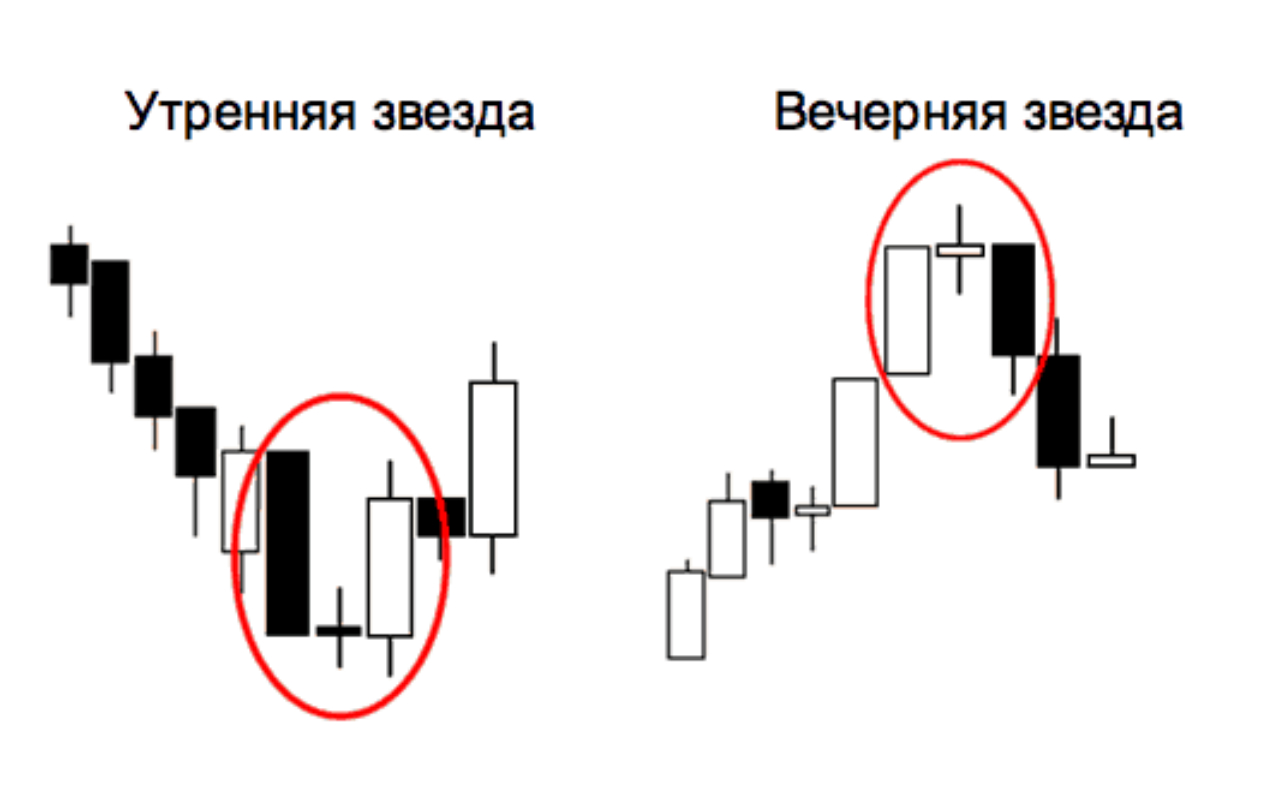

The Average Directional Movement Index, also known as ADX, is used to measure the strength of a trend. Harness past market data to forecast price direction and anticipate market moves. No matter your experience level, download our free trading guides and develop your skills. Forex Profit CalculatorOn average, a Forex trader can make anywhere between 5 to 15% of the initial amount they invested in the market. The Doji Candlestick is a pattern used in technical analyses of trend reversals in a market.

ADX helps you identify the strength of a trend, which will be useful for any contract being executed in the near future. This research represents an investigative look into how and why some indicators work and some don’t work as well. Shortly before that, the market had been going somewhat sideways with a relatively soft ADX reading. Notice that the market had relatively lower readings before spiking where it is circled. By looking at the reading, you can verify whether or not a trend is established, and whether or not a potential set up makes sense.

Average Directional Movement Index (ADX)

A few words of explanation in regards to us creating new indicators on the forum…. This movement can be characterized as either positive, negative, or neutral. Using the ADX, we can find out whether a trend is operative and decide whether to rely on momentum oscillators or use a trend-following approach.

Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. The chart above shows the Australian dollar/New Zealand dollar pair shows that it was going higher for a while, while the ADX readings continued to make lower higher. This means that although the momentum was going back and forth, the price was giving no sense of the underlying uncertainty. Now that we have eliminated the peripheral indicators, traders can focus directly on the ADX. Harness the market intelligence you need to build your trading strategies.

The average directional movement index is based on market directional movement. You must understand that Forex trading, while potentially profitable, can make you lose your money. Never trade with the money that you cannot afford to lose!

Best way of using Forex pivot point indicator in trading

The ADX calculation is based on a moving average of a price’s expansion of price over the previous 14 candlesticks, or a period of your choice. The ADX measures the moving average of expansion of a price during a given amount of time. Join thousands of traders who choose a mobile-first broker for trading the markets. Understanding markets gaps and slippageThe foreign exchange rate reveals valuable details about particular currencies a trader wishes to trade-in. One of the most popular trading markets in the world, the foreign exchange market allows investors to make quick money by trading currencies.

Wide Ranging BarsWide Ranging Bars are https://traderoom.info/ momentum indicators that help traders understand the market direction and identify ideal entry and exit points. If you rely solely on the dotted lines, it will provide false signals in more than 50% of the cases. Meeting the second condition – crossing the 20th level from the bottom up – is essential. It signals that the price is exiting the flat, and there is a directional movement (i.e., a trend) forming. Some people recommend opening a trade only after crossing the 30th level.

Strength does not always equate to a positive or negative movement in prices. Additional support from another indicator is required for a correct interpretation of price behaviour in these specific instances. The ADX indicator simply measures the strength of a trend and whether we’re in a trading or non-trading period. This method of technical analysis is used to identify the emergence of strong downtrends and buy signals. It is a tool that is both a trend indicator and an oscillator, which can be used on different markets, for example in forex trading or trading CFDs.

She was a mentor, speaker, and founder of stockmarket.com, a website dedicated to teaching others how to use technical analysis for trading decisions. The fx-sniper.ex4 is a moving average type custom indicator that smoothens price and is used to spot market trends. Trading trends is a market approach that traders always gun for, as they look for ways to take advantage of directional markets. The key to success and profit is sound money management and risk control. Always calculate your lot size and make sure you never exceed 1% or 2% risk per trade, most professional and successful currency traders never exceed 1% risk per trade.

JP225 Cash Index Trades in Tight Range as SMA Convergence Flashing Red – Action Forex

JP225 Cash Index Trades in Tight Range as SMA Convergence Flashing Red.

Posted: Tue, 17 Jan 2023 08:00:00 GMT [source]

We have another review – on the relative strength index RSI – that describes how to work with screeners with screenshots and practical examples. As soon as ADX rises above 20%, open a short Forex trading position as -DI is at the top. The stop-out level is the previous candle high, the yellow line. It’s reasonable to set a trailing stop instead of the regular stop. High and Low are the maximum and minimum values, while i and i-1 are the current and previous low and high periods, meaning the current and prior bars or candles.

Stochastic is a technical indicator of the type of oscillator. It’s popular among beginner traders due to its simplicity. Many professionals favor stochastic oscillators because of their signal accuracy and versatile applications. You can open trades when the dotted lines cross, and the index is above 40-50%, but it’s not recommended. But since the ADX peaks and shows high market activity, the trend can also continue.

Horizon, Q32 Bio team up to develop ADX-914 for autoimmune … – Seeking Alpha

Horizon, Q32 Bio team up to develop ADX-914 for autoimmune ….

Posted: Mon, 15 Aug 2022 07:00:00 GMT [source]

Luckily for us, every program today contains a canned vehttps://forexdelta.net/on of ADX and the components, -DI and +DI. It may pay, however, to grasp the calculation methodology because there is a lot of smoothing going on in ADX. The DM components are smoothed if only by the elimination of inside days, and ADX is smoothed by dividing by the ATR. This has the virtue of delivering a really reliable indicator, but one that may lag and is hard to interpret.

But don’t worry, we’ll be exploring newer volume indicators in future blogs to demonstrate different representations of volume. This shows not only does the market look like it is breaking out, but it also is gaining momentum. Later on, the red arrows point out where the market started to slow down as the markets leveled off, and the ADX started to turn later. The blue arrow shows that there was a large candle that traders could have taken as a buy signal, especially since the ADX started to rise higher. While the default setting is the last 14 candles, some traders will adjust the input to their individual needs.

- It is common investing wisdom that detecting and trading in the direction of a strong trend is a profitable strategy with minimal risk exposure.

- According ADX’s price divergence strategy, when a currency pair’s price increases in the market, ADX value should also increase and vice versa.

- It is often mistaken for a breakout of key levels, while it stays local without receiving confirmation and the price goes back to the flat corridor.

- The advantage for the trader is in knowing that momentum is not subsiding.

All you need to do is enter the price data in columns B, C, and D. Trading setup Trade on 15 minutes chart (can be traded on any chart except 1-min) 9 EMA applied to the close ADX applied… The buy signal remains in force as long as this low holds, even if +DMI crosses back below – DMI. This version deviates a bit since it allows 3 prices to be used ,but all the rest is same.

Recent Comments