It is called so because the Japanese will say the market is trying to hammer out a base. A hammer pictorially displays that the market opened near its high, sold off during the session, then rallied sharply to close well above the extreme low. Note it can close slightly above or below the open price, in both cases it would fulfill the criteria. Because of this strong demand at the bottom, it is considered a bottom reversal signal.

Candlesticks started being used to visually represent that emotion, as well as the size of price movements, with different colours. Traders use candlesticks to make trading decisions based on patterns that help forecast the short-term direction of the price. Candlestick charts are a useful tool to better understand the price action and order flow in the forex market. However, before you can read and explain a candlestick chart, you must understand what it is and become comfortable identifying and using candlesticks patterns. The doji is a reversal pattern that can be either bullish or bearish depending on the context of the preceding candles.

You can consider the crypto candlestick charts trading system as an individual crypto trading strategy, or you can use these tools in your strategy to increase your trading probability. When the hammer appears after a series of bearish candlesticks, it can potentially signify a bullish price trend ahead. A candlestick chart is a type of financial chart that shows the price action for an investment market like a currency or a security. The chart consists of individual “candlesticks” that show the opening, closing, high, and low prices each day for the market they represent over a period of time. In order to read a candlestick chart, figure out what each different part of a candlestick tells you then study the different shapes to learn about market trends.

High Price

If a Doji is spotted on a candlestick chart, this shows that the market suffered a lot of volatility during the session. A candlestick chart reflects a given time period and provides information on the price’s open, high, low, and close during that time. Look for a short body with a long bottom wick to spot a possible reverse in downtrend. These are called “hammers” because the wick looks like the handle and the body looks like the head of the hammer. Hammers indicate a possible reversal in a downtrend, especially when seen next to at least 1 week of candlesticks that show the market going down. This candlestick chart illustrates Ether’s daily price history over a three-month period.

Fill out the form to get started and you’ll have your own stock trading account within minutes. To the left you’ll see some various Japanese candle formations used to determine price direction and momentum, including the Doji, Hammer, Spinning Top, and Marubozu. No BS swing trading, day trading, and investing strategies.

In Forex, this candlestick is most of the time a doji or a spinning top, preceding a third candle which closes well below the body of the second candle and deeply into the first candle’s body. The first candle has to be relatively large in comparison to the preceding candles. This candlestick pattern generally indicates that confidence in the current trend has eroded and that bears are taking control. The classic pattern is formed by three candles although there are some variations as we will see in the Practice Chapter. A long legged doji candlestick forms when the open and close prices are equal. At the top of a trend, it becomes a variation of the hanging man; and at the bottom of a trend, it becomes a kind of hammer.

What Is a Bullish Candle?

Some individual candlesticks are seen as signals that are strong enough to mark the possibility of a change in price trends. Candlestick patterns are the most interesting and simple way of predicting the prices for creating your unique trading strategies. Candlesticks are the graphical representations of price movements which are commonly formed by the open, high, low, and close prices of a financial instrument.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. A slight variation of this pattern is when the second day gaps up slightly following the first long up day.

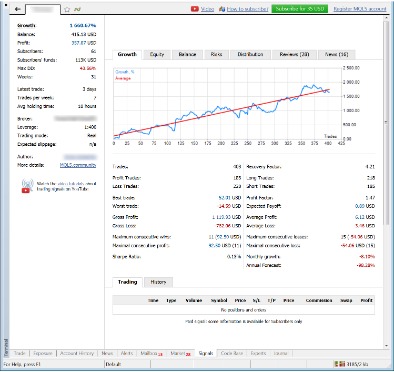

- To use the insights gained from understanding candlestick patterns and investing in an asset, you require a brokerage account.

- This information is the foundation of technical analysis, which you can read more about on Swyftx Learn.

- As commonly echoed, past performance is not an indicator of future results.

We have compiled all the types of candlestick patterns in one infographic. This infographic will be very useful for those who are using candlestick techniques to monitor market movement and also for those who are learning about them. Trade analysts use candlestick patterns to recognize market turning points and they are utilised to reduce one’s exposure to market risks. Also, candlestick patterns can be based on two candlesticks and at times even a series of multiple candlesticks can be used.

Related Articles

Everyone can try trading candlestick chart patterns on theLiteFinance demo account for free without registration. Trading Forex with candlestick patterns may seem complicated, but having learnt major patterns and practicing trading, you will learn to trade successfully. In this section, I will demonstrate an example of candlestick patterns trading in Forex with the trade volume of 0.01 lot.

This is also often one of the building blocks to the trading strategy which you can learn in our pro area. If there are more buyers than sellers, or more buying interest than selling interest, the buyers do not have anyone they can buy from. The prices then increase until the price becomes so high that the sellers once again find it attractive to get involved. At the same time, the price is eventually too high for the buyers to keep buying. Munehisa Homma, a wealthy Japanese merchant, devised a technical analytical approach to examine the price of rice contracts in the 18th century.

Generally, the longer the body of the candle, the more intense the trading. A candlestick is a popular method of displaying price movements on an asset’s price chart. Often used in technical analysis, candlestick charts can tell you a lot about a market’s price action at a glance – much more than a line chart. A hanging man candlestick looks identical to a hammer candlestick but forms at the peak of an uptrend, rather than a bottom of a downtrend. The hanging man has a small body, lower shadow that is larger than the body and a very small upper shadow.

If a hammer shape candlestick emerges after a rally, it is a potential top reversal signal. The shape of the candle suggests a hanging man with dangling legs. It is easily identified by the presence of a small real body with a significant large shadow. All the criteria of the hammer are valid here, except the direction of the preceding trend.

Bearish Candlestick

There are also continuation https://en.forexbrokerslist.site/, signaling the ongoing trend to continue. The hanging man looks the same as the hammer, but it appears during bullish trends and suggests that a correction to the downside might soon materialize. The Japanese Candlestick method of visualizing charts is one of, if not the, most popular methods of looking at charts for the modern trader. Investopedia requires writers to use primary sources to support their work.

A https://topforexnews.org/ change of the financial instrument (stock, derivative etc.) due to aspects such as psychological and fundamental over a period of time leads to a chart pattern. Candlestick patterns play a key role in quantitative trading strategies owing to the simple pattern formation and ease of reading the same. Long shadows can be a sign of uncertaintybecause it means that the buyers and sellers are strongly competing, but neither side has been able to gain the upper hand so far. If the market suddenlyshifts from long rising candlesticks to long falling candlesticks, it indicates a sudden change in trend and highlights strong market forces. It emerges during positive periods and typically indicates a reversal to the negative. A bullish candle initiates the pattern, which is followed by a minor bearish or bullish candle.

It indicates that the selling pressure from the first day may have subsided and that a bull market may be approaching. With a stronger signal, we should have a better chance of a new bull run forming. To see whether a market rose or fell in the time it covers, you just look at the colour of the candle. “Just starting to learn more about trading, this is good stuff.” Our trained team of editors and researchers validate articles for accuracy and comprehensiveness.

Check the line coming out of the bottom of the https://forex-trend.net/ to see what the lowest price for the market was. It’s important to make sure you know what the candlestick colors represent before you check the open and close prices to ensure you aren’t getting them confused. Always double-check the settings or the color key for the app or platform you are looking at the charts in.

Recent Comments